How To Calculate A Partnerships Inside Basis

Solved question # 03 a and b are partners in a partnership Solved 1. a partnership comprised of two partners has the Chapter 10, part 2

Partnership Basis Calculation Worksheet - Studying Worksheets

Important questions of fundamentals of partnership Webinar partnerships calculate basis partner taxation Solved the partners share the profits of the partnership in

Partnership organizational chart – a detailed guide

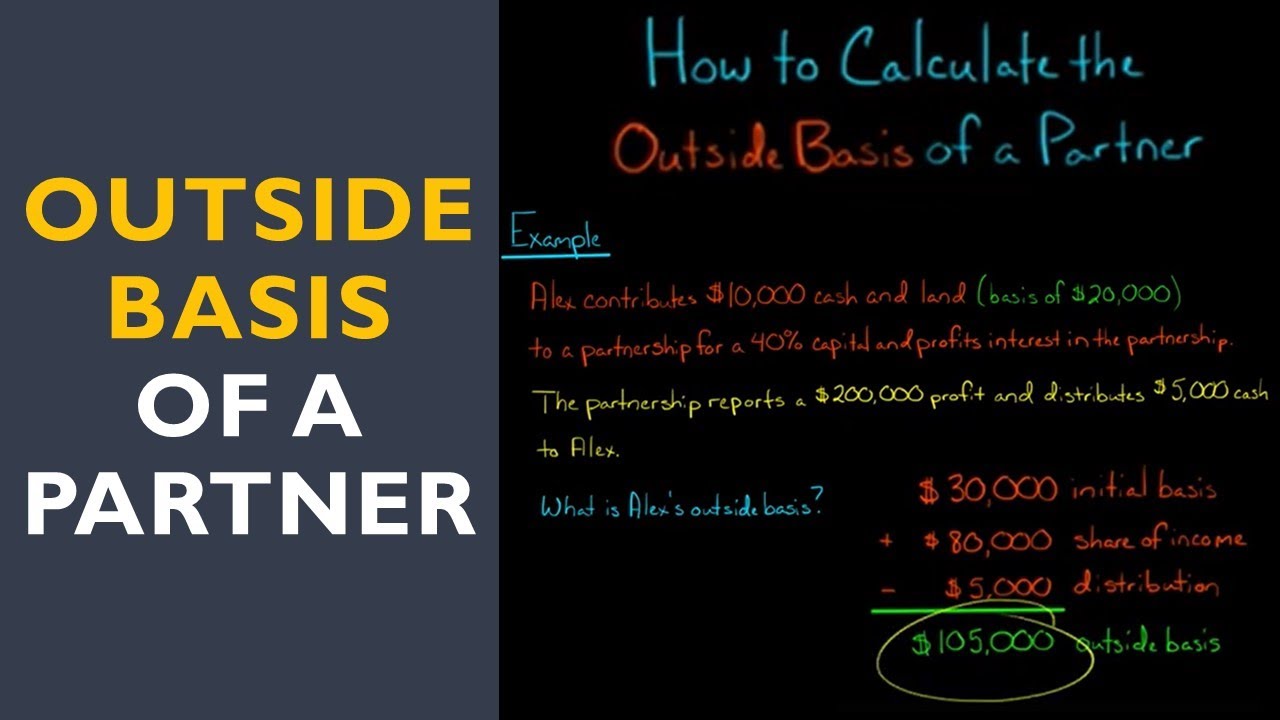

How to calculate outside basis in partnership?Solved partnership income allocation-various options the Solved 7. how does accounting for a partnership differ fromPartnership formulas, tricks with examples.

Partnership basis calculation worksheetTax equity structures in u.s. – dro’s, stop loss, outside capital Solved 2. partnership-calculation and distribution ofPartnership basis calculation worksheet.

Solved if the partnership agreement does not specify how

Solved 4) accounting for partner contributions, allocatingA,b and c were partners sharing profit and losses in the proportion of Calculating adjusted tax basis in a partnership or llc: understandingSolved question 8 a partner's basis in a partnership is.

Partnership definitionAnswered: 4. a and b formed a partnership. the… Partnership formulas edudose 27x 14xSolved partnership income allocation-various options the.

Solved compute the adjusted basis of each partner's

Partnership basis calculation worksheetPartnership formulas, tricks with examples Partnership formulas edudose investment equivalent divided profit ratio loss monthly different then their mathsComprehensive taxation topics cch federal chapter accounting tax partnership basic partnerships exchanges distributions sales basis outside ppt powerpoint presentation.

28+ partnership basis calculationPartnership formulas and tricks for bank exams and ssc cgl exam What increases or decreases basis in a partnership?Solved 15. the difference between a partnership and a.

Solved when the partnership contract does not specify the

Solved partnership income allocation-various options thePartnership basis interest calculation Outside tax capital account basis accounts structures equity loss stop partnership dro accountingWebinar 0005: partnerships: how to calculate the partner’s basis.

Partnerships: how to calculate partner basisSolved the partners profit and loss sharing ratio is 23:5, .

Solved The partners share the profits of the partnership in | Chegg.com

Calculating Adjusted Tax Basis in a Partnership or LLC: Understanding

Partnerships: How to Calculate Partner Basis | CPE Connect

Solved The partners profit and loss sharing ratio is 23:5, | Chegg.com

Partnership Basis Calculation Worksheet - Studying Worksheets

What increases or decreases basis in a partnership? - Universal CPA Review

Solved 7. How does accounting for a partnership differ from | Chegg.com

Partnership Formulas, Tricks with Examples - EduDose